Prior to making FULL or partial tax payments, please contact the appraisal district for a current amount due. **Walker County Appraisal District cannot guarantee the accuracy of the delinquent tax amount due. Quarterly payments that are made according to Section 31.031 of the Texas Property Tax Code are not considered delinquent. If your property is currently under protest, the values will not be viewable on the website until your hearing is complete. Partial Payments or contract payments may not be reflected. Greenville County property records for real estate brokers Residential brokers can inform their clients by. Document copies available from 1911 to 2021. Create a free login to search deeds, liens, oil & gas leases, right of ways, plat maps and more. Indicated amount may not reflect delinquent tax due beyond a 5 year history. Hunt County Clerk Official Public Records. Information Pertaining to Delinquent Property Taxes:

The Appraisal District shall not be liable for any damages whatsoever arising out of any cause relating to use of this application, including but not limited to mistakes, omissions, deletions, errors, or defects in any information contained in these pages, or any failure to receive or delay in receiving information.

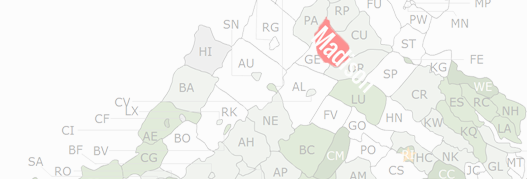

HUNT COUNTY CAD SOFTWARE

By using this application, you assume all risks arising out of or associated with access to these pages, including but not limited to risks of damage to your computer, peripherals, software and data from any virus, software, file or other cause associated with access to this application.

HUNT COUNTY CAD VERIFICATION

Verification of information on source documents is recommended. Original records may differ from the information on these pages. The Appraisal District reserves the right to make changes at any time without notice. The Appraisal District makes no warranties or representations whatsoever regarding the quality, content, completeness, accuracy or adequacy of such information and data. Please contact the Appraisal District to verify all information for accuracy. Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents. The information included on these pages has been compiled by staff from a variety of sources, and is subject to change without notice. Information provided for research purposes only. Dedication to our goal to provide as much assistance to the taxpayer and general public alike, have. The Tax Assessor-Collector of Hunt County collects for many of the taxing jurisdictions within the county. Every effort has been made to offer the most current and correct information possible on these pages. Customer Service Hours: Monday-Friday: 8:00 AM - 4:00 PM.

0 kommentar(er)

0 kommentar(er)